Financing

When a large medtech company sets up a venture fund, it typically invests in technologies that are adjacent to its pre-existing portfolio. Intuitive Surgical’s approach is different.

An additional $50m brings the neurovascular intervention specialist’s total Series F funding to $82m. Route 92 says it will use the capital to build its sales and support teams and pursue regulatory authorizations around the globe for its FreeClimb portfolio while advancing its SUMMIT MAX clinical trial for the investigational Monopoint Reperfusion System.

<p>Executive Summary</p> <p>An interactive look at medtech and diagnostics deals made during August 2024. Data courtesy of Biomedtracker.</p>

<p>Executive Summary</p> <p>An interactive look at pharma, medtech and diagnostics deals made during August 2024. Data courtesy of Biomedtracker</p>

This week, the FDA announced a new head of its device evaluation office; synthetic genomics firm Constructive Bio landed $58m in funding; and Natera got a permanent injuction against NeoGenomics Labs' RaDaR assay.

This week, Neuralink announced it received US FDA breakthrough device designation for a device to restore sight; medtechs Discure and DeepLook secured new funding; FDA pump recalls from B. Braun Medical and Fresenius Kabi; Axonics prevails in patent infringement lawsuit with Medtronic; Merit Medical buys Cook Medical for $210m.

This is a story about the current activity in Chinese biopharma financing.

Amferia is developing an antimicrobial peptide hydrogel dressing to combat infections in acute wounds in humans and veterinary contexts. Supported by €1.2m of new venture capital financing, the company is planning pivotal clinical studies to support an FDA application later this year and CE mark submission in 2026-2027.

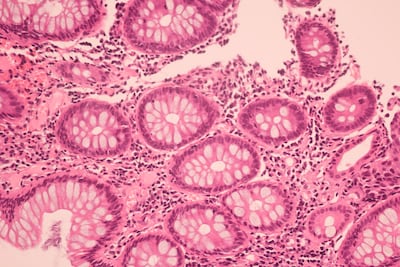

The New York-based augmented intelligence health care services provider has secured $20.7m in series B funding to support clinical validation and commercialization of its AI-powered breast cancer morphology diagnostic test PreciseBreast. The company intends for its test to advance current approaches to recurrence prediction comprising clinician histopathology assessment and genomic testing.

This week, a medical group sued the FDA to block a lab-developed test rule; the FDA published guidance on device classifications; Defibtec issued a recall of its chest compression device and ICU Medical updated instructions for its infusion pump batteries; Maui Imaging raised a $4m DOD grant to put imaging tech into military-based trauma units.

BridgeBio spun out oncology assets in May to focus on rare diseases and now it has sliced off a few rare disease candidates for GondolaBio. Also, Avidity and Kymera closed follow-on offerings that grossed $345.1m and $225m, respectively, and Vandria extended its series A round to $30.7m.

With $150m in series A funding, the Versant- and Novartis-backed start-up is betting it can overcome the challenges to getting RNA medicines into the kidney.

Without a mega-merger like 2023’s Pfizer/Seagan takeout, M&A deals grew smaller during the first half of 2024, while volume rose. In alliance deals, H1 2024 activity somewhat mirrored activity from H1 2023.

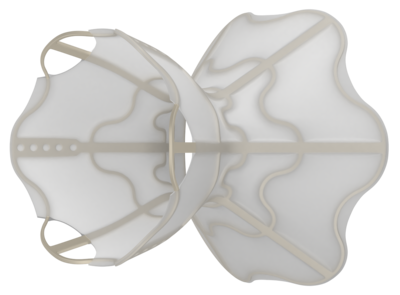

J&J buys heart failure implant company V-Wave, whose Ventura Interatrial Shunt could be the first device of its kind aimed to reach the roughly 800,000 patients in the US who experience heart failure and reduce ejection fraction every year.

The start-up launched last year with Phase III-ready upacicalcet, which has nearly completed two pivotal trials in secondary hyperparathyroidism and for which it has exclusive rights outside of Asia.

Moximed aims to accelerate adoption of its MISHA Knee System, De Novo-approved by the US FDA in April 2023, with $91m in Series D funding. Chris Gleason, president and chief executive officer, offers perspective on the company’s innovative technology and commercial growth activities.

Announced in conjunction with a $97m Series D financing round, Neptune underscores its gastrointestinal focus and robotics aspirations by spinning out Jupiter Endovascular, which will leverage $21m of the funding to support ongoing development of its Endoportal Control technology.

An interactive look at pharma, medtech and diagnostics deals made during July 2024. Data courtesy of Biomedtracker.

In this week's podcast edition of Five Must-Know Things: Merck & Co. steps into CD19 bispecific space; gene therapy patients rise, but slowly; Madrigal’s Rezdiffra plans; Korean biopharma financing recovering?; and approvals to watch out for in Q3.

Restructuring Edition: Lykos recruited a J&J veteran to help its slimmed-down staff resubmit its MDMA-based PTSD therapy. Also, Lexicon cut its field force by 50%, or 75 jobs; Viracta cut its solid tumor program and 23% of its workforce; and Boundless Bio streamlined with moderate job cuts.

ADVERTISEMENT